Hallo my best friend, back again with me, MCM10. this time I will discuss a best invention for the future of Investment world. well, for more details let's follow my discussion this,

Nousplatform is a unique new platform created specifically for investors and to help create a decentralized fund.

The platform's creators offer excellent, and very innovative, products for the future of the Invesatsi world they call Nousprotocol, which makes it possible to create different types of investment funds for the management of assets from Blockchain.

In addition, you have access to various tools for managing your portfolio.

To perform various operations and transactions on this platform, the Nousplatform team created Nous Token, which is available to all its users.

With their help, you can buy shares from investors who are in reserve portfolio.

This operation will create the dynamics of growth by increasing the liquidity of funds.

Benefits for the Manager

- Decentralized funds are managed separately.

- The fund-raising campaign for closed funds (ICO), publishes its own ETF index.

- Validate fund shareholders.

- Confirm the balance of the wallet of funds through a smart contract.

- Nous token, as a reliable digital currency on the block to interact with investors and funds.

- Reserve Nous tokens to improve the liquidity of open-end funds.

- The Nous community to attract funds to new investors.

Benefits for investors

- Invest in the main funds created on the Nous platform.

- Diversify risk in choosing the highest fund with various portfolio assets.

- Use snapshots recorded on blocks to analyze the profitability of funds.

- Trading the ETF index on a decentralized Nous exchange.

- What problems the Nousplatform solved.

- Transparency of reporting of funds.

- bank or broker.

- High threshold, high commissions.

- Bind to a specific currency.

- Lack of comparative statistics.

- Language barriers, complex reporting.

- Difficulty in obtaining ETF Index.

- Weak opportunities for portfolio diversification.

See the video about Nousplatform below,

New Generation Investment Fund.

The creation of protocols is entrusted to smart contracts operating in blockbusters.

It is they who determine the conditions of interaction between depositors and funds. This protocol is required to allocate access rights wherever and wherever.

In addition, it is able to extend the functionality of share contracts by connecting third party services.

Going forward, the plan will include a market of sixty nine trillion dollars.

The Boston Consulting Group study shows that assets managed by traditional managers grew by 7%, over the period from 2016, and reached over $ 69 trillion.

Token Nous plays the role of a major digital currency intended to regulate investor relations and funds.

The depositors may, in return for Nous, purchase other portfolio assets on the exchange.

We strive to ensure that, so the Nous token is transferred to an open-end fund, designed for a quick settlement with investors.

Such actions ensure an increase in the liquidity of the fund. An effective example of Nous implementation can be considered as BlackRock, Inc., today the largest investment fund.

Capitalization has reached $ 5.4 trillion.

If funds prefer to work on a decentralized scheme, then all transactions will be made in the Nous token.

Another obvious example is the issuance of the ETF index through ICO.

Capitalization has reached $ 5.4 trillion.

If funds prefer to work on a decentralized scheme, then all transactions will be made in the Nous token.

Another obvious example is the issuance of the ETF index through ICO.

Capitalization has reached $ 5.4 trillion.

If funds prefer to work on a decentralized scheme, then all transactions will be made in the Nous token.

Another obvious example is the issuance of the ETF index through ICO.

Token Publishing Plan.

- 70% sold on token sale.

- 20% detained by Nousplatform.

- 5% Advisory, Grants, Partnership.

- 3% Community.

- 2% to cover tokensale.

Use of Results.

- 30% technical development.

- 20% Legal Fees and Licenses.

- 15% Marketing and Business Development.

- 15% Real Estate Fund.

- 15% Crypto Asset Fund.

- 5% Operational Cost.

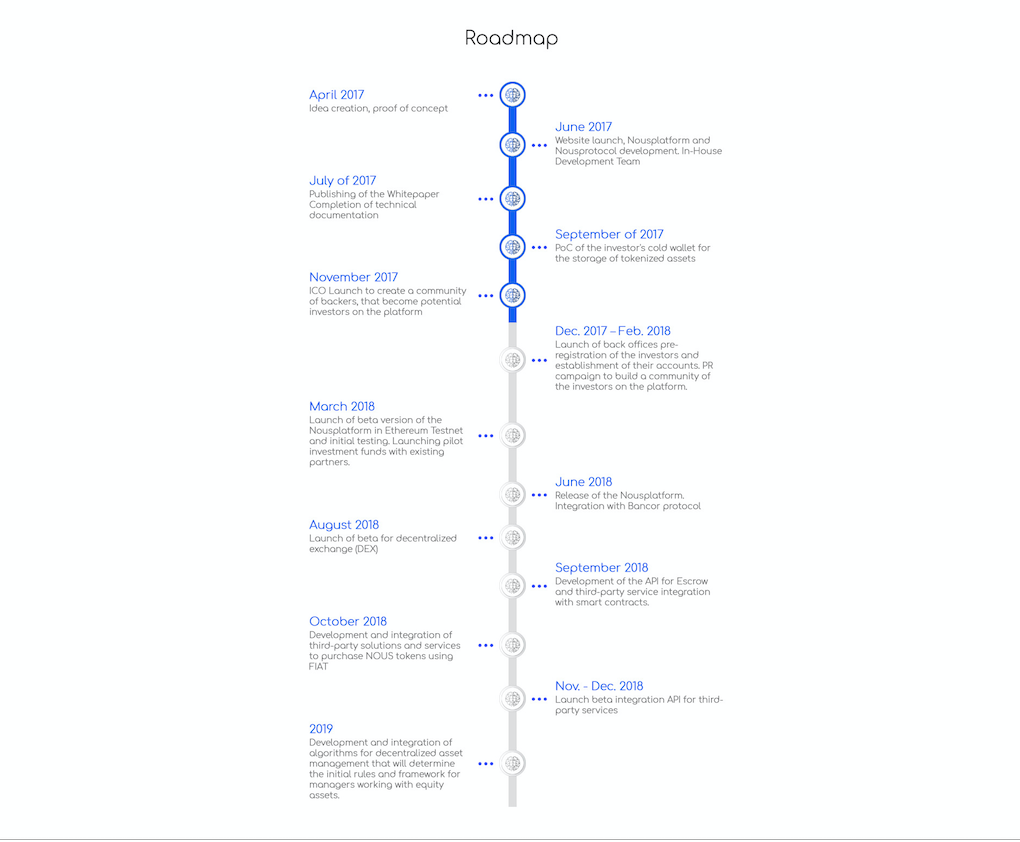

Roadmap.

Team Nousplatform.

H.E. Lord DR Gery Maes.

CEO.

Alex Man.

Managing Director & Co-Founder.

Anatol Ostrowski.

CTO & Co Founder.

Bonnie Normile.

Consultant, Investor Relations.

Andrew Vorobyovski.

CMO & Co-Founder.

Victor Pulyaev.

COO & Co-Founder.

Team Advisors

Jhon Cioe.

Founder/CEO - INOV8 Sport.

Brian Kusmer.

Brian Kusmer Real Estate Business Professional in 20 years responsible for hundreeds of million in transactions volume. He is in the top 1% of business perfomer in the world.

Ken Tachibana.

MBA Finance, UC Berkeley Haas School of Business. Global Chairman of Cyber Exec, Founder and managing principal of Intelligence Capital.

Partners.

Tidak ada komentar:

Posting Komentar