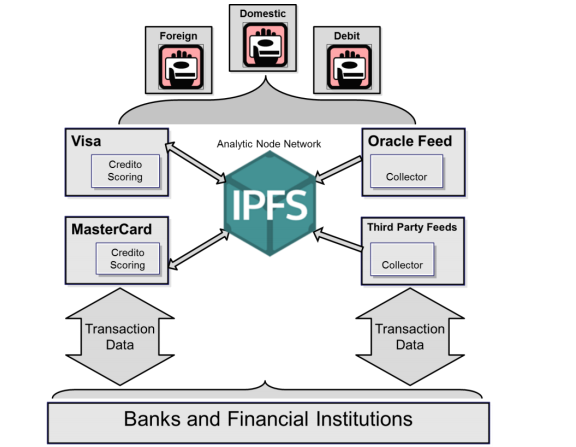

Credito is a decentralized credit intelligence network that provides credit scores, transaction value and loan markets supported by Blockfain Ethereal, Intelligent Contract and IPFS, which increases transparency and reliability for a better, more secure future.

About Credito.

This is a project supported by chain block technology.

This project is focused on giving people more use of crypto currency.

They use smart contracts on the Ethereum network with a 20m ERC compatible token, Tokens created for the purposes of this project.

The founder of Credito wants to reach everyone who can track transactions. With this new, decentralized platform, we can track transactions, credit scores and more.

The market suffers huge losses of hundreds of billions of dollars a year because of the exploitation of others working.

There are many cheats and it is very difficult to trace.

They have found a solution to this.

Their goal is to create a market where you will have the ability to lend or borrow some funds.

There will be no third person involved, only the person who borrows and lends.

Their communication will be better and faster, and also very safe.

They can meet each other faster at any time, where they go, and the cost is lower.

This will bring revolutionary things in this field.

Principles and Value of Credit Design.

- Decentralization.

- Safe, transparent and expandable system.

- Modularity for simple and flexible system design.

- Safe, transparent and expandable system.

Credito Solutions.

As a solution to the above problems, we have created Credito Network, or just simply called Credito.

Decentralized networks based on the Etaceum blockade coupled with smart contracts and the Interplanetary File System (IPFS) that provide the Credit Intelligence and Decentralized Lending Marketplace.

Decentralization through the use of Intelligent Contracts also removes the trust requirements between borrowers and lenders, providing an unsecured and transparent loan environment that is not available on the market today.

Smart Contracts achieve this through predefined parameters thus eliminating the need for trust between the participating parties.

They are also completely transparent and visible to anyone using the label printing block.

- Credito is Transparent.

- Loan Agreement is an Intelligent Contract.

- Credito is "without trust".

people who are very competent people who have knowledge and with the help of their people in the team managed to make it happen.

The leader of the Credito team is Srikar Govindarajula.

On teams with big block-chain developers, marketing agencies, SEM experts, and more,

https://credito.io/credito.io

Loan agreement process, there are 6 stages to be done, namely :

- The creator makes a credit order in CreDApp requesting a loan by promising Token A as security for Token B, determining the interest rate, LVR and expiry time desired, and signing the request.

- CreDApp adds the builder's credo creates reports to the request, verifies that the author has enough token A and freezes it until the loan is serviced or the loan request expires, and sends a request through Credito.

- The attacker cuts the request and decides to fill it.

- The recipient submits a request signed by the manufacturer with his signature to Credito.

- Credito authenticates Author autographs, verifies that the request has a smart assurance management contract by transferring security to a smart contract.

- CreDApp stores and runs Smart Contract on Ethereal Blockchain and Token B is transferred from Taker to Maker.

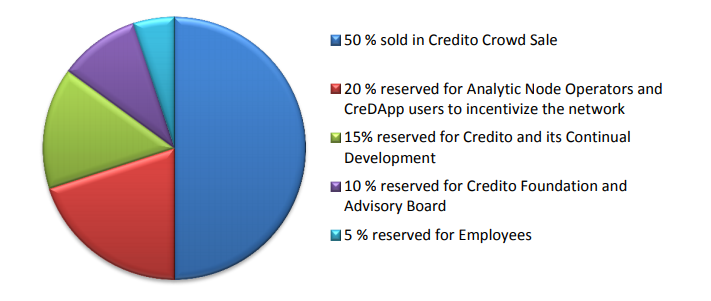

Distribution Token.

To continue the development, Credito will conduct "TGE" Sales and Sales once, with 50% of tokens available for public sale.

The TGE start date will soon be announced and will provide a loan of US $ 1 billion.

As follows :

Employee distribution has a 12 month transition period, 25% - every quarter, with 6 months old rock. The proportional allocation for the ownership of each employee on the day the token is sold.

With the distribution of Dana Credito, the transition period is 12 months.

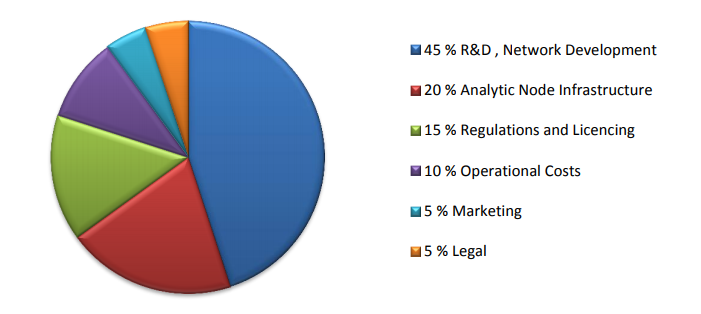

Use of funds provided.

Roadmap.

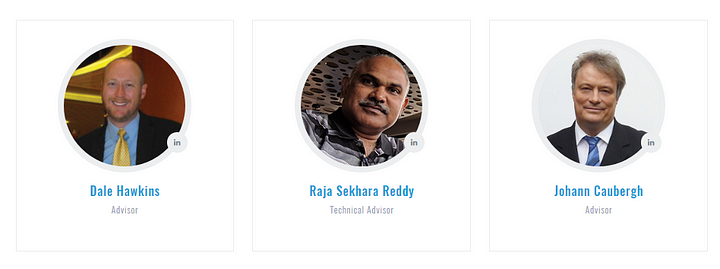

Team Credito.

Partners.

if you are interested or feel something is less clear, please you directly see the website below,

- Website: https://credito.io/

- Whitepaper: https://credito.io/pdf/whitepaper.pdf

- Announcement: https://bitcointalk.org/index.php?topic=2483679.0

- Facebook: https://www.facebook.com/CreditoNetwork

- Twitter: https://twitter.com/CreditoNetwork

- LinkedIn: https://www.linkedin.com/company/credito-network

Author by MCM10

Tidak ada komentar:

Posting Komentar